Years Experience

Claim Settlement Ratio

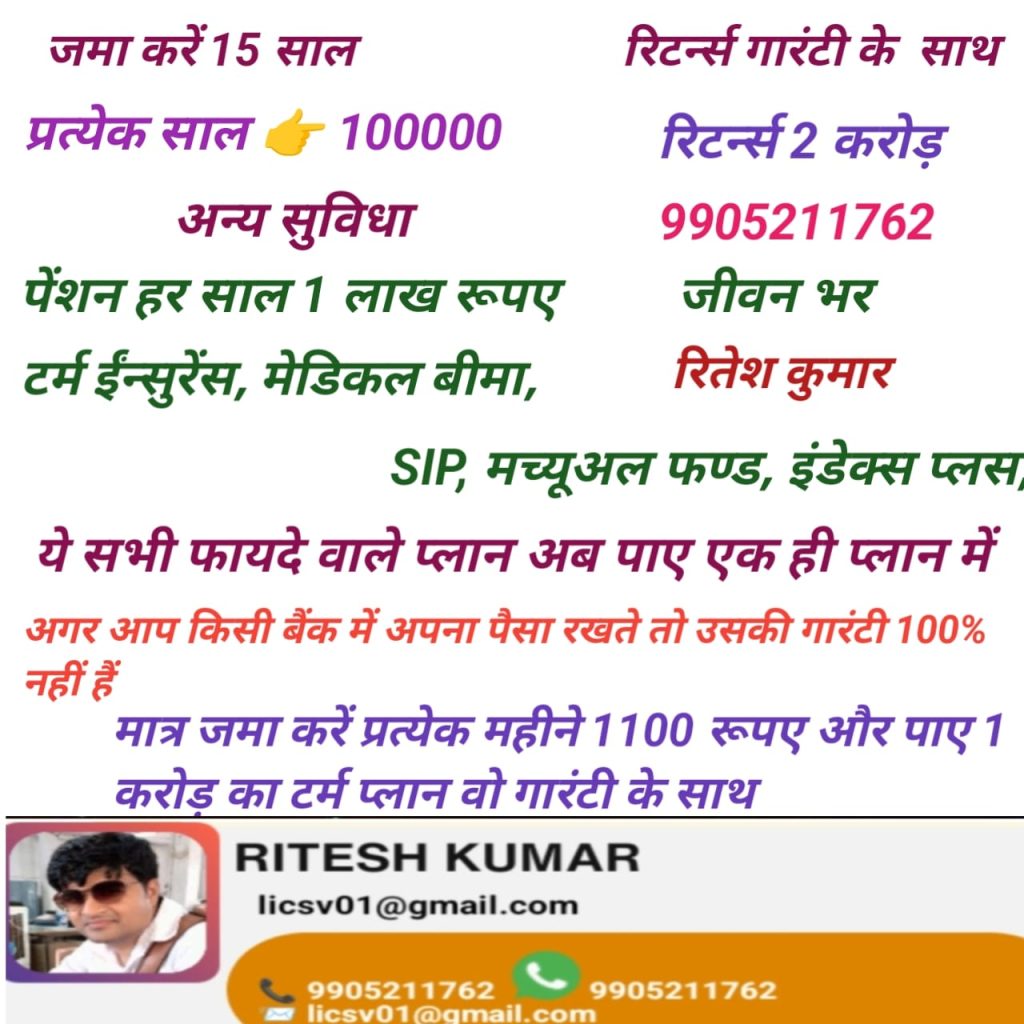

टर्म प्लान, एंडोवमेंट प्लान, मनी-बैक, रिटायरमेंट प्लान फायदे: टैक्स सेविंग, फैमिली प्रोटेक्शन, लॉन्ग टर्म सेविंग

व्यक्तिगत और फैमिली फ्लोटर प्लान कैशलेस हॉस्पिटल नेटवर्क प्रीमियम कैलकुलेटर

कार और बाइक इंश्योरेंस थर्ड पार्टी बनाम फुल कवरेज इमरजेंसी असिस्टेंस और कैशलेस गेराज नेटवर्क

FD प्लान्स का परिचय ब्याज दरें और टेन्योर ऑप्शन टैक्स सेविंग FD विकल्प

SIP क्या है और क्यों ज़रूरी है? इंडेक्स प्लस निवेश का लाभ टॉप परफॉर्मिंग फंड्स की जानकारी

Contact for all types of Insurance and Financial Advisor at LIC (specializing in all types of investments).

कम प्रीमियम में उच्च कवर वाली सुरक्षा

Affordable premiums with high coverage

Affordable premiums with high coverage

Affordable premiums with high coverage

Guaranteed returns at maturity

Bonus additions over policy term

Tax benefits under Section 80C & 10(10D)

Periodic payouts during policy term

Survival benefits at fixed intervals

Death benefit to nominee

Regular pension income after retirement

Accumulation and vesting phases

Option for joint life annuity

Affordable premiums with high coverage

आपकी अनुपस्थिति में परिवार को वित्तीय सुरक्षा और सहायता

व्यवस्थित बचत और भविष्य के लिए धन संचय

गंभीर बीमारी की स्थिति में लाभ का भुगतान (राइडर के रूप में उपलब्ध)

Covers hospitalization, pre and post hospitalization expenses

Sum insured from ₹2 lakhs to ₹2 crores

Cover for pre-existing diseases after waiting period

10,000+ empaneled hospitals across India

24/7 emergency assistance helpline

Quick claim settlement within 2 hours for cashless

Simple online claim submission

Assistance for document collection

Fast reimbursement within 7 working days

Tax benefits under Section 80D

Free health check-ups after claim-free years

No-claim bonus increase in sum insured

Get expert advice from our insurance specialists to find the perfect coverage for your

needs.

Stay informed with our expert articles on insurance and financial planning

C/o Satender Bharti Mahadeva, Slempur Siwan, Bihar- 841227

Add- Village- Tinbheriya Kala, Post- Barahani Bazar, District- Siwan, Pin Code- 841227, 841226

कैशलेस क्लेम में, आप हमारे नेटवर्क अस्पताल में भर्ती होने पर सीधे अस्पताल के कैशलेस डेस्क से संपर्क कर सकते हैं। अस्पताल हमारे साथ सीधे लेन-देन करेगा और आपको केवल बीमा कवरेज के बाहर की राशि का भुगतान करना होगा। इस प्रक्रिया के लिए आपको पूर्व अनुमोदन प्राप्त करने की आवश्यकता होती है, जिसे अस्पताल या हमारे क्लेम टीम के माध्यम से व्यवस्थित किया जा सकता है।

A Mutual Fund is an investment vehicle that pools money from multiple investors to invest in stocks, bonds, or other assets, managed by professional fund managers.

A SIP (Systematic Investment Plan), on the other hand, is a method or way of investing in a mutual fund — where you invest a fixed amount regularly (monthly or quarterly) instead of a lump sum.

I am Ritesh Kumar, Senior Insurance and Financial Advisor at LIC (specializing in all types of investments).