Introduction

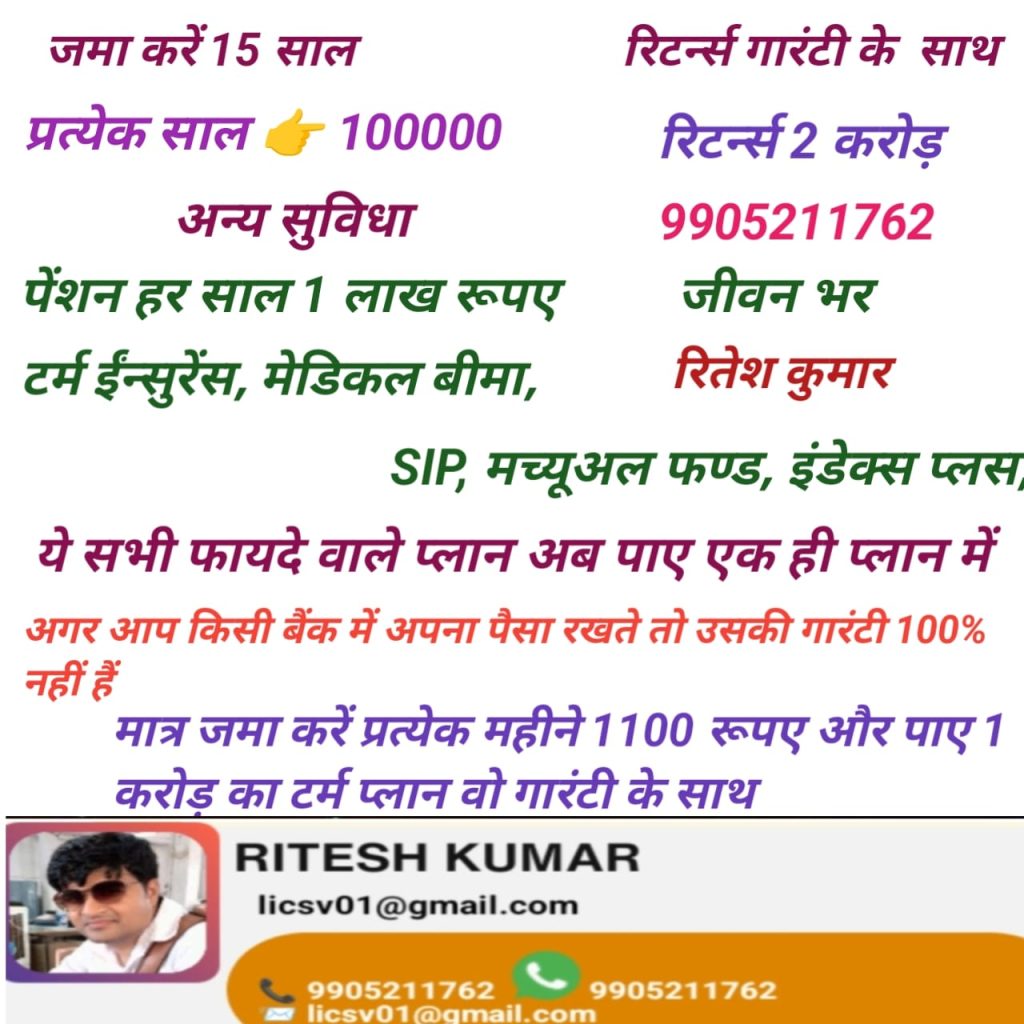

At IndiaKaBima, we believe that financial security isn’t a luxury—it’s a necessity. Whether you’re safeguarding your loved ones with robust insurance or growing your wealth through diversified mutual fund investments, our mission is clear: to secure your present and amplify your future with trusted service and expert advice.

Why Choose IndiaKaBima?

- Comprehensive Coverage: From life and health to vehicle and home insurance, we’ve got you covered.

- Mutual Fund Expertise: Navigate equity, debt, hybrid, and goal-oriented schemes with confidence.

- Proven Performance: Backed by over 15 years of experience, 2 million+ satisfied clients, and a remarkable 97% claim settlement ratio.

Insurance Services: Protect What Matters

- Life Insurance – Secure your family’s future. IndiaKaBima tailors plans to match your dependents’ needs and financial goals.

- Health Insurance – Shield yourself from medical uncertainties with comprehensive hospital and post-care cover.

- Vehicle and Home Insurance – Protect your assets against damage, theft, or disasters.

- Custom Consultancy – Walk through policy options with our experts to find the best fit for your lifestyle and budget.

Mutual Fund Services: Grow Your Wealth Wisely

India’s mutual fund industry offers diversified financial growth. Here’s how we guide you:

- Variety of Schemes: Invest in equity for long-term growth, debt for stability, or hybrid for balanced returns.

- Start Small, Grow Big: Begin investing from as little as ₹500 through SIPs, making wealth creation accessible to everyone.

- Goal-Oriented Investing: Choose solution funds focused on specific life goals like education, retirement, or wealth creation.

- Regulation & Trust: As an industry aligned with AMFI guidelines, we ensure ethical standards and investor protection.

Our Approach: Tailored, Transparent, Trustworthy

| Feature | Description |

|---|---|

| Holistic Advisory | Insurance + investment planning designed around your personal goals |

| Personalized Solutions | Plans crafted to suit your risk appetite, family needs, and timeline |

| Digital Access | Seamless online service, swift policy issuance, SIP setup, and updates |

| Client-Centric Service | Trusted support, high claim settlement, and transparent mutual fund guidance |

Recent Trends & Industry Updates

- SEBI is now incentivizing mutual fund houses to onboard first-time women investors, including offering SIPs starting at ₹250!

- Jio BlackRock has secured SEBI’s approval and launched the advanced ‘Aladdin’ analytics platform in India, enhancing mutual fund accessibility and insights.

- Increasing shift towards direct mutual fund plans—especially among younger investors—can potentially yield higher returns due to lower fees.

Call to Action

Ready to secure your future and grow your wealth? Partner with IndiaKaBima today!

- Visit IndiaKabima.com to request a free quote or personalized consultation.

- Join millions of satisfied clients who trust us for their financial planning needs

Conclusion

At IndiaKaBima, we’re more than just insurance or mutual fund providers—we’re your financial partners. From ensuring peace of mind through comprehensive coverage to unlocking growth via smart investments, we’re devoted to helping you thrive.

Secure today. Build for tomorrow. Trust IndiaKaBima.